In the first article of this series, we explored various methods for international wire transfers, comparing traditional banks and digital platforms. The second article took a deep dive into the step-by-step processes of setting up and using platforms like Remitly and Remitly Circle. Now, in the third article, we shift focus to trust. It’s not just about how long international wire transfers take; it’s about ensuring your money is safe and reaches your loved ones efficiently and securely.

Let’s Start with the Basics: Why Trust Matters

The digital world offers incredible convenience, but it also brings uncertainty. Data breaches, rapid technological advances, and the lack of personal interaction can erode confidence. However, by doing your research—reading reviews, verifying licenses, and testing customer support—you can find a provider that aligns with your needs and gives you peace of mind.

Pro Tip: Information You’ll Need for an International Wire Transfer

A legitimate financial platform takes measures to protect your money. Thus, ensure you are not asked to provide sensitive information like PINs or social security numbers. The kind of information you may need to provide to complete an international wire transfer includes:

- An identification certificate such as an ID or passport

- Recipient’s Name and Account Number

- IBAN or SWIFT/BIC Code

- Receiving Bank Name and Address

Sending money via a digital platform, akin to a digital wire transfer, may require different information, as these transfers are powered by secure, innovative digital networks that provide a modern alternative to traditional bank wire systems. Depending on where you’re sending money to, you might also need to provide additional details such as the source of funds or reason for payment, to comply with the laws in your destination country.

What to Look for in a Financial Management Platform

Trust is the foundation of any financial relationship. In the digital age, where face-to-face banking becomes less frequent, individuals may feel uncertain about virtual services. To help build confidence, here are key aspects to consider:

How Long Do International Wire Transfers Take? It Depends on the Platform

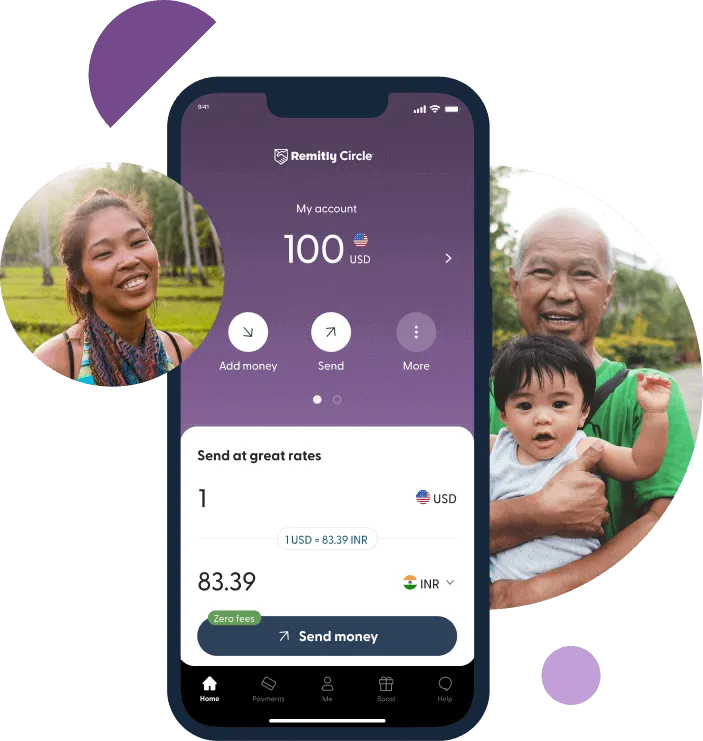

Transfer times vary widely. Traditional bank wire transfers may take several days, while digital platforms like Remitly can complete transactions quickly, but still depend on a sender to be available to set up the transfer. Of course, there are alternative remittance platforms that eliminate the traditional wire transfer experience altogether. Remitly Circle provides globally shared accounts to which both the “sender” and the "recipient" have access. This means you no longer need to wait for the sender to transfer money. As long as the shared account stores funds, the recipient has immediate access to it and can initiate a “digital wire transfer” to their own bank account (or another preferred method to receive the money) whenever they choose. If you still opt for a remittance platform, verify timelines before committing to a provider.

Security Measures

Look for encryption, two-factor authentication, and adherence to regulations like AML (Anti-Money Laundering) and KYC (Know Your Customer). This information should be listed on the platform’s website, app store profile, and within the app itself.

Customer Support

Evaluate responsiveness by reaching out to the provider’s customer service. Test their availability and problem-solving skills to ensure you’ll have support when needed.

Social Proof: How to Evaluate a Financial Platform’s Credibility

When it comes to your money, you need to know it is handled carefully. In addition to verifying a financial platform’s legitimacy with the authorities, social proof is an important factor to consider.

App Store Ratings: User reviews on platforms like Google Play or App Store offer firsthand insights into the user experience, ease of use, and reliability of a financial service.

Detailed Customer Reviews: Platforms like Trustpilot feature in-depth reviews from users. Look for recurring themes in feedback about speed, security, and customer support. Pay close attention to how providers respond to negative reviews. A thoughtful and professional response indicates a commitment to customer care, while a lack of response or dismissive tone can be a warning sign.

Word of Mouth: Seek opinions from friends, family, or online groups. Trusted referrals often come with valuable firsthand insights.

Putting Trust into Action

Trust is essential when choosing a digital financial management platform. You can confidently select a provider that fits your needs by verifying transfer times, evaluating security measures, and leveraging social proof. Whether you’re navigating a financial emergency or sending money for routine support, taking the time to choose wisely ensures your hard-earned money is in safe hands.

In the next article, we’ll delve deeper into the process of international wire transfers, breaking down each step to help you streamline your financial transactions. Stay tuned…

.jpg)