Why is Remitly Circle closing?

To make managing your money simpler, we’re bringing everything together in one trusted app: Remitly.

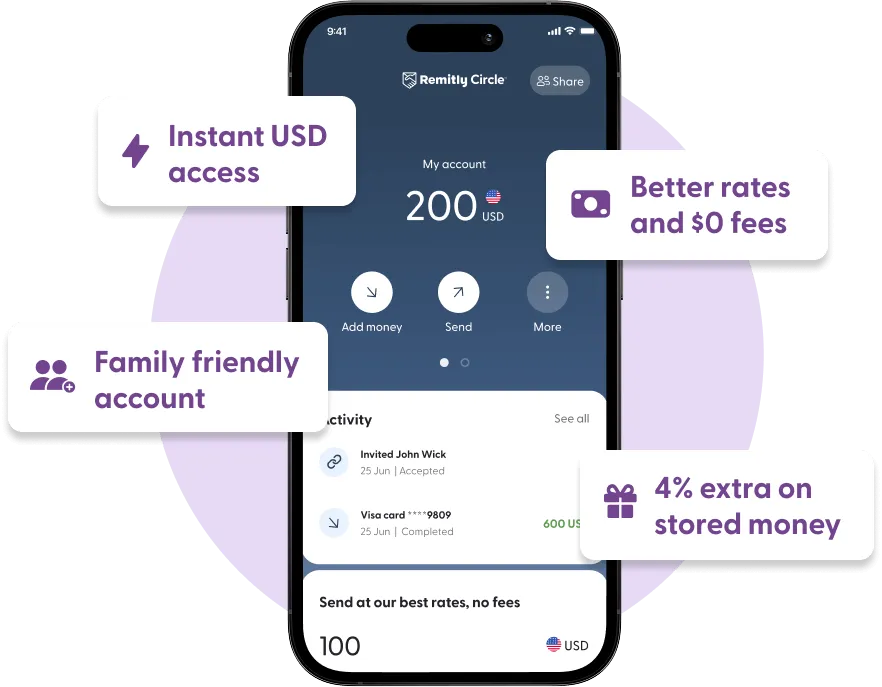

The new Remitly Wallet lets you store, send, and manage your money all in one place.

What is Remitly Wallet?

Remitly Wallet is a secure account within the Remitly app that helps you stay ready for every transfer, simply, securely, and always with Remitly’s best rates.

- Add and hold funds in USD to keep money safe and ready to send with our best rates. Stay prepared for family support, future goals, or life’s surprises.

- Send money instantly from your balance when the time is right, so transfers arrive quickly and reliably.

- Spend globally with the Remitly debit card and enjoy no foreign transaction fees when you use your wallet balance online, in stores, at home, or abroad.*

- Keep more of what’s yours with no monthly fees, no minimum balance requirements, and no fees to add money.

- Trust the app millions rely on for secure, on-time transfers. Remitly Wallet is built right into the Remitly app, offering the same reliability, protection, and peace of mind you already know.

*Banking services and the Remitly Debit Card are provided by Lead Bank. The Remitly Debit Card is issued by Lead Bank pursuant to licensing by Visa® U.S.A. Inc. Fees may apply. Remitly, Inc. is a licensed money transmitter, not a bank. See Terms and Cardholder Agreement for further details.

What’s happening to the Remitly Circle app?

The Remitly Circle app will be permanently removed from the App Store and Google Play after December 14, 2025, and will no longer be available to download or reinstall. All Remitly Circle services will also end on this date.

Who can I contact for help?

If you have questions or need support, please visit our Help Center for step-by-step guidance.

What if I still have money in my Circle account?

If you haven’t opened your Remitly Wallet yet, your money is still safe. You can open your wallet to move your balance, or you can request a refund at any time through our Customer Support team. You can also request your Circle transaction history from the past 24 months by contacting Customer Support.